1

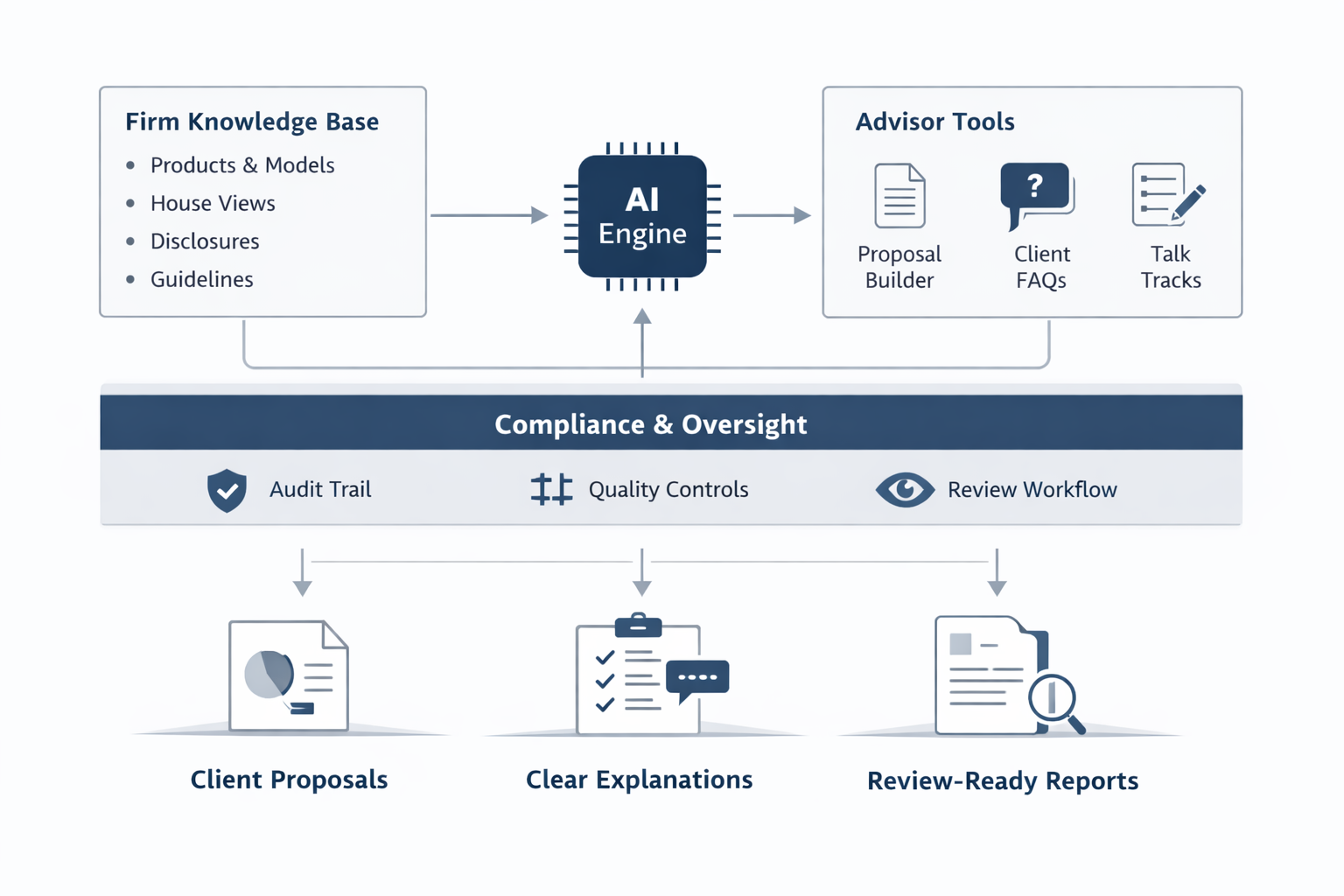

Centralize firm knowledge

Upload and maintain your approved products, model portfolios, house views, disclosures, and positioning.

Solutions - Wealth Management Firms

WealthLink helps wealth management firms standardize how advisors recommend, explain, and document advice so every client interaction is faster, more consistent, and easier to supervise.

As wealth management organizations scale, advisor productivity and client experience begin to diverge. Recommendations vary by advisor, explanations lack consistency, and supervisory teams struggle to review rationale at speed. Meanwhile, advisors spend too much time preparing proposals and explaining products instead of serving clients.

WealthLink is an AI-powered advisor enablement platform designed for wealth management firms. It equips advisors with institution-approved recommendations, explanations, and client deliverables while giving leadership the governance, visibility, and consistency required at scale.

1

Upload and maintain your approved products, model portfolios, house views, disclosures, and positioning.

2

Advisors generate proposals, explanations, FAQs, and talk tracks that automatically align with firm standards.

3

Leadership maintains consistency through structured outputs, reviewable logic, and firm-level controls.

Advisors generate client-ready proposals that follow firm-approved structure, language, and positioning without starting from scratch.

WealthLink produces consistent, plain-English explanations advisors can use in meetings, ensuring every client hears a clear and aligned message.

From structured products to alternatives, advisors receive guided explanations, FAQs, and suitability framing based on firm inputs.

Outputs are structured, repeatable, and reviewable, reducing back-and-forth between advisors and supervisory teams.

Generate standardized, client-ready proposals.

Meeting-ready narratives aligned with firm positioning.

Consistent answers sourced from firm-approved materials.

Structured summaries that preserve institutional knowledge.

Ensure outputs meet accuracy and firm standards.

Firm-aligned insights to support advisor conversations.

WealthLink is designed for enterprise deployment. Firms control the inputs, logic, and language the AI uses, ensuring advisors move faster without introducing unmanaged risk.

WealthLink is designed for flexible deployment, allowing firms to start quickly and expand usage over time.

WealthLink generates all advisor outputs using firm-approved products, language, and structures.

Yes. Outputs are standardized and review-ready, making supervision faster and more consistent.

No. WealthLink complements existing CRMs and portfolio platforms by enhancing advisor productivity and client communication.

Firms can begin with a pilot team in weeks and expand gradually across the organization.

Yes. Templates, language, and logic can be configured by team, channel, or strategy.

See how WealthLink helps wealth management firms scale advisor productivity while delivering a consistent, governed client experience.

Request a firm demo