1

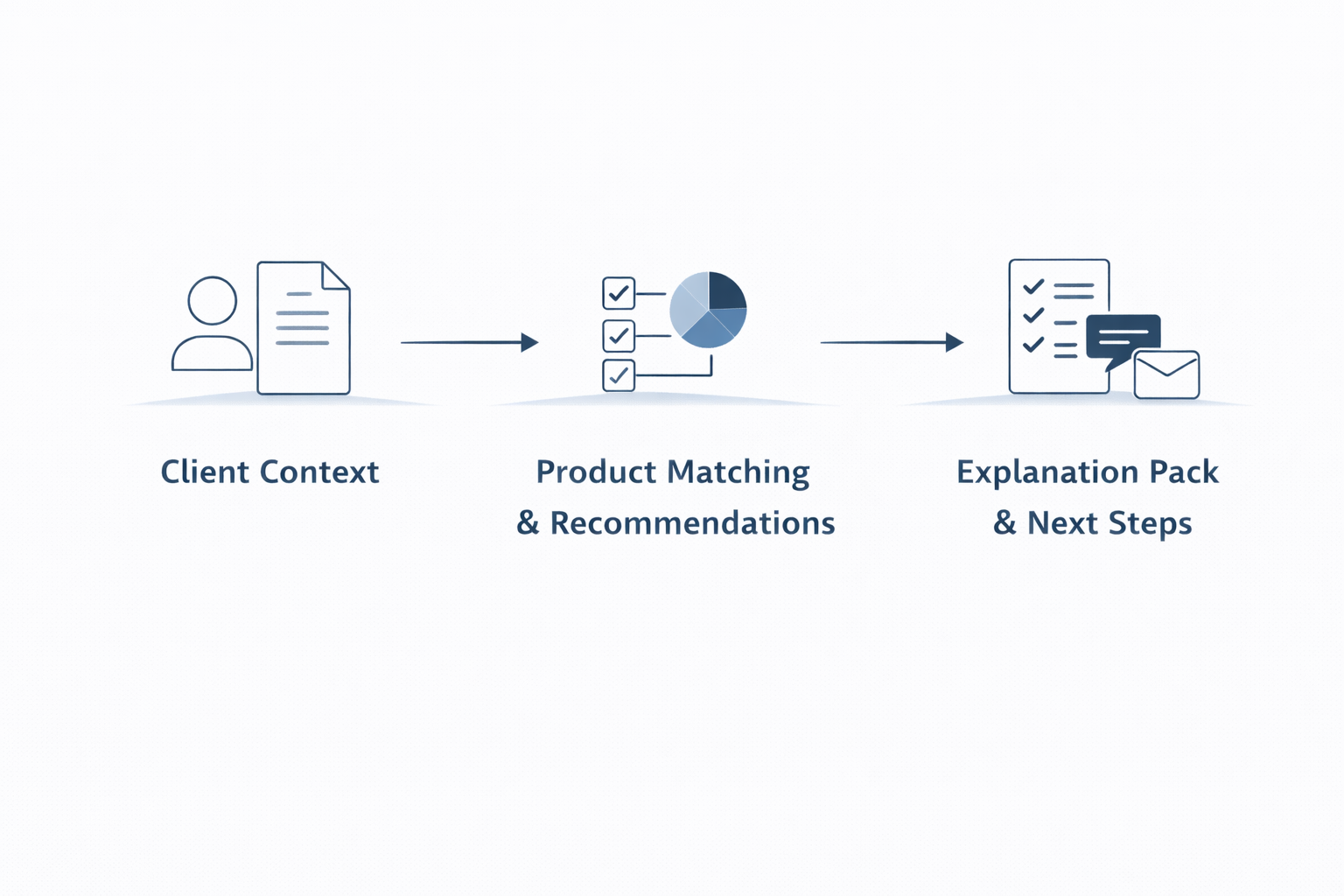

Capture client context

Use Client Remarks to capture goals, preferences, constraints, and what the client actually cares about—while the system automatically updates the analysis.

Solutions - Financial Planners

WealthLink helps financial planners match suitable investment solutions to client goals, explain tradeoffs in plain English, and generate meeting-ready talk tracks, FAQs, and client-ready proposal summaries, fast.

Financial planning is relationship-driven, but the work around recommendations can be repetitive and time-consuming: comparing options, explaining tradeoffs, answering the same questions, and building a client-friendly write-up that does not sound generic.

What WealthLink Does for Financial Planners

WealthLink is an AI-powered planning assistant that helps you connect client context to suitable investment solutions, then produces the communication assets you need to move the plan forward: analysis, talk track, FAQs, and a client-ready summary.

1

Use Client Remarks to capture goals, preferences, constraints, and what the client actually cares about—while the system automatically updates the analysis.

2

WealthLink generates a Matched Product List and shows Match Analysis across factors like risk preference, liquidity, time horizon, region/currency exposure, and sector preferences so you can explain the fit.

3

Generate your Sales Pitch (talk track), FAQ responses, and a polished Investment Proposal summary the client can review.

Use Case 1

When a client plan points to an investment move, WealthLink helps you quickly narrow the universe to a few best-fit options, then arms you with the reasoning behind each one.

Before / With / Outcome

What you use in WealthLink

Use Case 2

Clients do not just ask what you recommend. They ask what could go wrong, what it costs, and whether it fits their timeline. WealthLink generates consistent, plain-English answers you can use in meetings or follow-ups.

What you use in WealthLink

Use Case 3

When markets are moving, clients need context that maps to their plan and positioning. WealthLink helps you provide a clear explanation, not a generic market recap.

What you use in WealthLink

For clients

For the firm

Use Case 4

WealthLink turns your recommendation into a structured, client-friendly summary so clients walk away with clarity and a next step, not a pile of jargon.

What you use in WealthLink

Store client goals, preferences, and meeting context, with analysis updated automatically.

shortlist best-fit solutions quickly

explain fit across risk, liquidity, horizon, and preferences

compare alternatives side-by-side

meeting-ready talk track + objections handling

client-friendly explanations and answers

interactive Q&A in real time

market context for why now conversations

quality control and consistency for outputs

WealthLink is designed to produce structured, reusable advisor deliverables so your recommendations are consistent, explainable, and easier to communicate across clients.

No. Its core value is matching solutions to client context and generating the explanation tools (analysis, FAQs, talk tracks) that support the recommendation.

Yes. WealthLink helps translate planning goals and constraints into a shortlist of suitable investment solutions with clear tradeoffs.

It gives you a ranked shortlist, why this fits reasoning, and meeting-ready talk tracks and FAQs to handle questions smoothly.

No. WealthLink supports how you communicate and implement recommendations, without claiming to replace your planning platform.

Yes. Similar Product and Match Analysis make it easy to compare options and explain differences in plain English.

See how WealthLink helps financial planners match the right solutions to each client and deliver clear, client-ready explanations.

Book a demo