1

Client Insight and Personalization

Turn client context, preferences, goals, and sentiment into actionable insight fast.

Solutions - RIAs

WealthLink helps RIAs cut through data noise to uncover client needs, generate smarter product matches, and deliver clear, compliant explanations so you can win more first meetings and serve clients deeper at scale.

Get a demo

RIAs are serving more clients, supporting more products and strategies, and facing higher expectations for personalization without a proportional increase in advisor capacity. The result is noise: scattered data, inconsistent recommendations, and too much time spent researching instead of advising.

What WealthLink Does for RIAs

WealthLink is an AI-native advisory platform that helps RIAs identify what matters to a client, match them to the most suitable products or model portfolios, and generate the explanation pack advisors need to move forward confidently.

1

Turn client context, preferences, goals, and sentiment into actionable insight fast.

2

Generate smarter product/model matches aligned to the client profile and your approved shelf.

3

Get real-time answers, comparisons, and what to say next guidance backed by firm inputs.

4

Spot patterns that drive engagement, retention, and next-best actions without relying on guesswork.

1

Pull in prospect/client details, goals, risk preferences, holdings, and notes so recommendations start with the full picture.

2

WealthLink ranks best-fit products/models and shows why they fit, including scenario comparisons and tradeoffs advisors can explain.

3

Generate the client-ready narrative: recommended options, plain-English explanation, FAQs, talk track, and follow-up/onboarding next steps.

Before WealthLink: long research, scattered data, inconsistent recommendations.

With WealthLink: instant client insights, personalized prep, smarter product matches.

Outcome: better first-meeting success and shorter decision cycles.

Product-fit is only useful if the client understands the why. WealthLink helps advisors translate complexity into clarity so recommendations do not feel like jargon or a template.

What advisors get

WealthLink supports ongoing engagement by surfacing what changed, what matters, and what to do next so clients feel consistently looked after.

For clients

For the firm

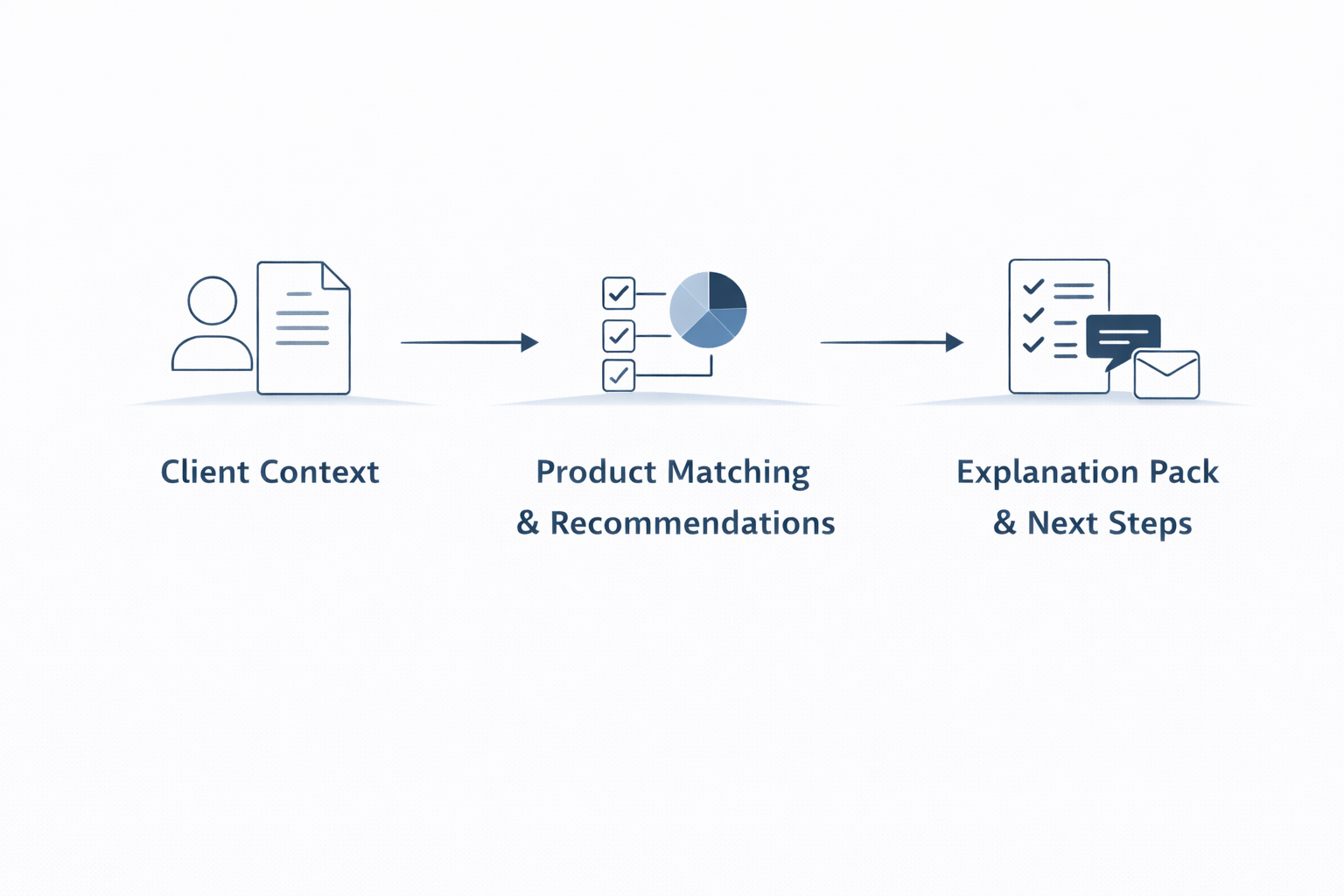

What This Looks Like in the Platform

The workflow maps directly to how advisors prepare, explain, and follow up with clients.

Built for Fiduciary Advice (Not a Black Box)

WealthLink is designed for fiduciary advice workflows so recommendations can be explained, reviewed, and trusted.

Highlights

Where WealthLink Fits in Your Stack

WealthLink complements your CRM and portfolio tools by adding what is usually missing: contextual intelligence that helps advisors match products to clients and communicate recommendations clearly.

WealthLink matches products to client goals, risk preferences, constraints, and context, then explains the rationale in plain language.

Yes. WealthLink can be configured to recommend only from your firm preferred products, models, and guidance.

No. It is designed for ongoing advice workflows too, including monitoring signals, client communication, and repeatable explanation packs.

No. You can start with lightweight inputs and exports, then add integrations as needed.

No. WealthLink complements existing systems by improving recommendation quality, consistency, and client communication.

See how WealthLink turns client context into smarter recommendations and client-ready explanation packs, so your team can scale advice without sacrificing personalization.

Get a demo