Average ROI

340%

within first year

WealthLink

AI

WealthLink

AI

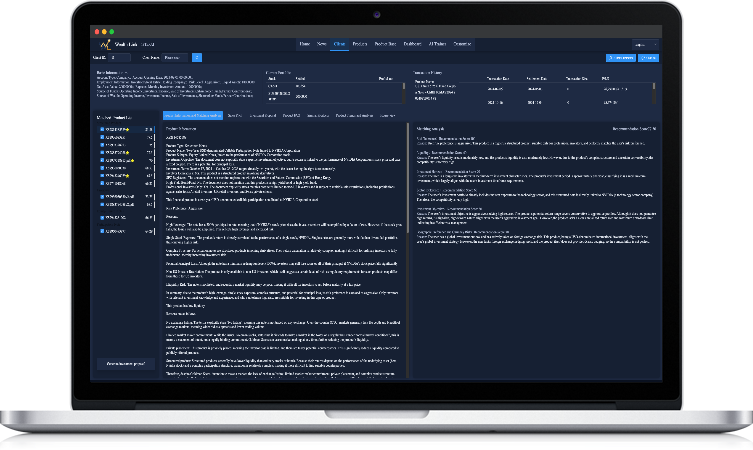

The AI Engine for Modern Wealth Advisory

WealthLink empowers wealth managers with intelligent agents to match clients with the right products, generate compliant proposals, and accelerate sales success.

Platform Pillars

Everything you need to deliver exceptional client experiences and drive revenue growth.

Matched Product

Allianz Hong Kong Equity Fund

Matching Analysis Breakdown

The investor's risk profile is assessed as aggressive, while the financial product's risk profile is assessed as growth-oriented. The two are relatively close in terms of risk preference, but the investor has a higher risk tolerance. Considering the suitability principle, the product is suitable for investors with an aggressive risk preference, and therefore receives a higher score.

Client: John Doe

Risk Profile: Growth

Selected Product: Morgan Stanley Global High Yield Bond Fund

“The market has been volatile recently. Considering that your assets are mainly in stable deposits, we’ve selected a high-yield bond fund to help improve your overall return while keeping volatility controlled.”

This fund is likely a non-principal protected product. Its objective and strategy depend on the underlying assets and the issuer’s credit. Market conditions, credit rating, and liquidity risk should be considered.

Due to limited product data, advisors should consult the official prospectus for detailed objectives, risks, and suitability.

2025-07-08 12:00

North American fund products: How to find the one that best suits me

2025-07-07 13:15

Hong Kong bonds products: Please help me analyze them separately

Accuracy Score

4.2

Compliance Score

4.1

Dimension 3 Score

3.9

Why Firms Choose WealthLink

WealthLink understands the unique challenges of wealth management and delivers solutions that make a real difference.

Every recommendation and document is generated with regulatory compliance in mind. WealthLink is undergoing a SOC 2 Type II certification.

Works with your existing CRM and portfolio management systems.

Bank-level encryption and data protection for client information

AI-powered insights based on up-to-the-minute market news

340%

within first year

94%

improved ratings

Recognition

Recognized at BOCHK CHALLENGE 2024

Innovative Design

Honored for exceptional design innovation and user experience excellence.

Greatest Tech Solution

Recognized for breakthrough technology and transformative AI capabilities.

Live walkthrough

Schedule a personalized session and discover how WealthLink can transform your wealth management practice.

FAQ

Helpful answers about how WealthLink supports modern advisory teams.

WealthLink ingests your product shelf, historical performance, and risk parameters to generate proposals aligned to each client’s goals and compliance guidelines.

Yes. WealthLink integrates with leading CRM and portfolio management platforms so client and account data stays synchronized.

All data is encrypted in transit and at rest. WealthLink is built with role-based access controls and ongoing security monitoring to protect your clients.

Most teams launch within two weeks. We provide guided implementation, advisor training resources, and ongoing success support.

Our solution team can configure bespoke workflows, approval gates, and disclosures tailored to your firm’s policies.

Submit the demo request form above or email Info@1step.ai for additional details.